What Problems Is AT&T Facing? Discover the Troubles That Hinder Growth

AT&T is facing problems such as a lack of clear revenue growth tied to 5G network deployments and exposure to toxic lead cables, which has impacted its stock performance and financial stability. These issues have caused concern among investors and raised questions about the company’s long-term prospects.

Despite its extensive network reach and past dominance in the telecom industry, AT&T’s performance has been negatively affected by industry headwinds and potential financial risks. As a result, the company has experienced a decline in stock value and faces challenges in regaining investor confidence.

Lack Of Revenue Growth From 5G Deployments

AT&T is facing a significant problem when it comes to revenue growth from their 5G network deployments. Despite investing in spectrum auctions and network upgrades, they have not seen a clear increase in revenue. The lackluster growth in 5G revenue has had a negative impact on AT&T’s overall performance.

In recent years, the telecom industry as a whole has struggled with generating revenue from 5G deployments. AT&T, along with other industry players, spent over $100 billion on additional spectrum during auctions in 2020-2022, while also investing in network upgrades.

However, this investment has yet to translate into substantial revenue growth for the company. This has led to AT&T’s stock hitting a 30-year low and raised concerns about the company’s financial outlook. Additionally, AT&T faces risks related to toxic lead cables in its network infrastructure, which further adds to its financial challenges.

Financial Risks And Lead Cables Exposure

AT&T is facing unquantifiable financial risks due to its exposure to toxic lead cables. Citi analysts have suggested that the company has a significant exposure to lead cables, which is creating a long-term overhang for AT&T stock. This is a cause for concern as AT&T’s network reaches approximately 40% of homes in the U.S.

These risks pose a potential threat to the company’s financial stability and could have a negative impact on its stock performance. AT&T will need to address these risks and take necessary measures to mitigate any potential financial impact.

Increasing Competition And Market Share Loss

AT&T is facing increasing competition and market share loss due to intensifying competition in the telecom industry. Competitors such as Verizon and T-Mobile have managed to gain a larger share of the market, putting pressure on AT&T to retain and attract customers in this highly competitive landscape.

This challenge of keeping up with the competition and maintaining market share is a significant hurdle for AT&T to overcome in order to stay relevant in the industry. AT&T needs to develop strategies to address this issue and find unique ways to differentiate itself from its competitors to regain its market position.

Failure to do so may result in further market share loss and a decline in overall performance.

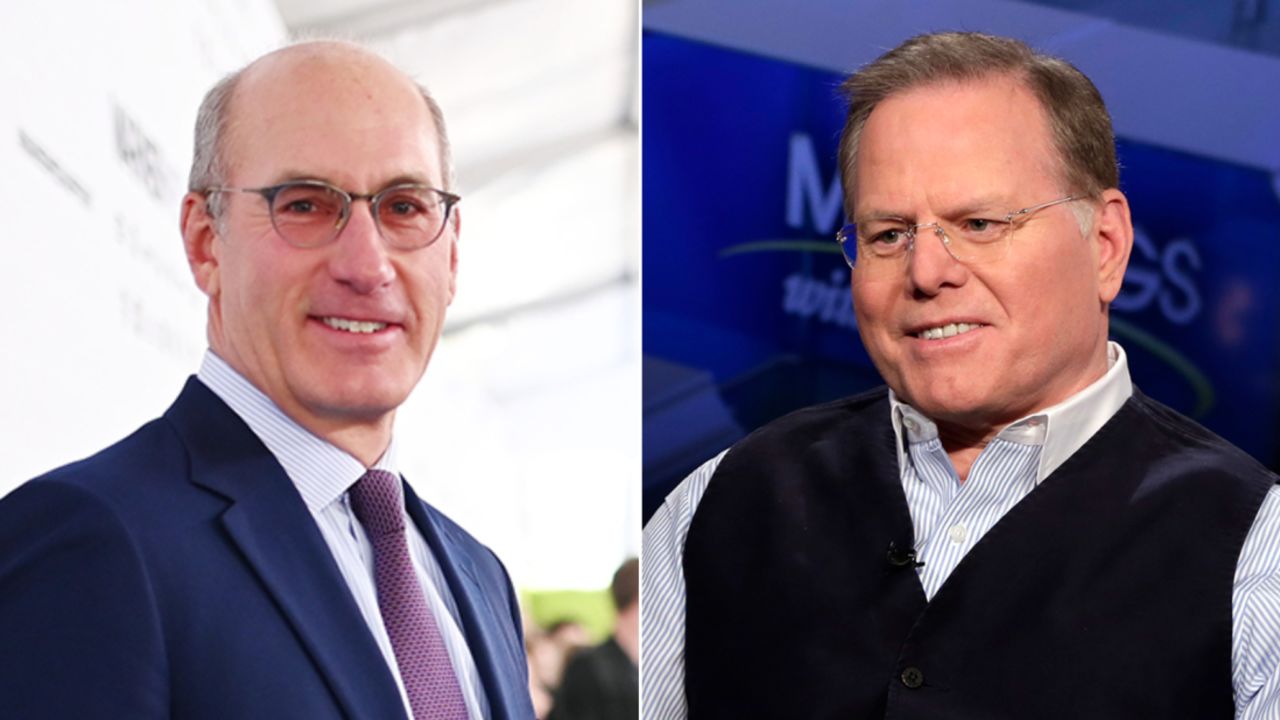

Credit: www.cnn.com

Why is AT&T trading so low?

There are some general factors that might contribute to AT&T’s low stock trading price. Please note that the situation may have changed since then, and I recommend checking recent financial news for the latest updates.

Competition in the Telecom Industry:

The telecommunications industry is highly competitive, with numerous players vying for market share. AT&T faces competition not only from traditional rivals like Verizon and T-Mobile but also from newer entrants and disruptive technologies.

Declining Traditional Services:

AT&T has historically been a major player in providing traditional landline and cable television services. However, these services have been facing a decline due to the rise of cord-cutting and the shift toward streaming platforms. This decline can impact their overall revenue and profitability.

Debt Burden:

AT&T has a significant amount of debt on its balance sheet, primarily stemming from acquisitions like Time Warner. High levels of debt can affect investor sentiment as it raises concerns about the company’s ability to manage its financial obligations and invest in growth opportunities.

Shift to 5G Technology:

While 5G technology presents opportunities for telecom companies, it also requires substantial investments in infrastructure and network upgrades. These investments can strain a company’s financial resources, impacting short-term profitability and potentially leading to lower stock prices.

Regulatory Changes:

The telecom industry is subject to various regulations that can impact business operations and profitability. Changes in regulations or new policies can have both positive and negative effects on AT&T’s financial performance.

Changing Consumer Preferences:

Consumer preferences are evolving, with more emphasis on data services and digital experiences. AT&T needs to continually adapt to these changing preferences to remain relevant and competitive.

Dividend Pressures:

AT&T has been known for its dividend payouts, which can be attractive to investors seeking income. However, maintaining high dividend payments can restrict the company’s ability to invest in growth initiatives, which can affect long-term stock performance.

Market Sentiment:

Market sentiment and investor perception play a significant role in stock price movements. Negative news, analyst downgrades, or broader economic concerns can lead to a decline in stock prices, even if the company’s fundamentals are sound.

It’s important to note that stock prices are influenced by a complex interplay of factors, and the above points are just a few potential reasons for a low trading price. To get the most accurate and up-to-date information, I recommend checking financial news sources and reports on AT&T’s recent performance and developments.

Frequently Asked Questions On What Problems Are AT&T Facing?

Why Is At&T Doing Poorly?

AT&T is facing challenges due to a lack of clear revenue growth connected to 5G network deployments. Despite spending over $100 billion on additional spectrum and network upgrades, the telecom industry, including AT&T, is struggling. Another significant problem AT&T is facing is the potential financial risks associated with toxic lead cables.

Citi analysts suggest that AT&T’s network, which reaches about 40% of homes in the U.S., may have a substantial exposure to these cables, creating a long-term overhang for the stock. Additionally, a Wall Street Journal report revealed that AT&T’s historical use of lead-covered cables is contaminating many parts of the country, leading to concerns and a plunge in their stock.

These challenges have contributed to AT&T’s poor performance in recent years.

Is AT&T at Risk?

AT&T is facing several risks that could impact its performance. One major concern is the lack of clear revenue growth linked to 5G network deployments in recent years. Additionally, the company has invested over $100 billion in acquiring additional spectrum and upgrading its networks.

Another risk factor is the potential financial liability associated with the use of toxic lead cables, which are present in about 40% of homes in the U.S. These risks could create a long-term overhang for AT&T’s stock. The company’s shares have already hit a three-decade low due to concerns about the lead cables contaminating various parts of the country.

Overall, AT&T is facing challenges in terms of revenue growth and potential financial liabilities, which could impact its performance and stock value.

Why Is At&T Tanking?

AT&T is facing several problems that are causing its decline in stock value. One major issue is the lack of clear revenue growth tied to its 5G network deployments. Despite spending over $100 billion to acquire additional spectrum and upgrade networks, AT&T has not seen significant revenue growth from these investments.

Additionally, AT&T is facing unquantifiable financial risks due to its exposure to toxic lead cables, which are contaminating many parts of the country and could create long-term consequences for the company. These challenges have contributed to the decline in AT&T’s stock value, as investors are becoming increasingly concerned about the company’s future prospects.

What Is The Future For AT&T?

AT&T is facing several challenges and uncertainties in the future. One of the main issues is the lack of clear revenue growth tied to 5G network deployments in recent years. Additionally, the company has spent billions of dollars on spectrum auctions and network upgrades, impacting its financial performance.

Another significant problem is the risk of exposure to toxic lead cables, with AT&T’s network reaching about 40% of homes in the US. This creates a potential long-term overhang for the stock. The telecom industry as a whole, including AT&T, has been affected by these issues, leading to a decline in the company’s stock value.

These challenges raise concerns about AT&T’s performance and its ability to overcome these obstacles in the future.

Conclusion

To summarize, AT&T is currently facing several challenges in the telecom industry. One major problem is the lack of clear revenue growth tied to their 5G network deployments. Despite spending over $100 billion for additional spectrum and network upgrades, AT&T has not seen the desired financial returns.

Additionally, the company is at risk due to its significant exposure to toxic lead cables, which reach about 40% of homes in the US. This creates long-term financial risks and weighs on the stock’s performance. Furthermore, AT&T’s historical use of lead-covered cables has led to contamination concerns and contributed to a decline in its stock value.

These issues highlight the obstacles that AT&T is currently grappling with, necessitating strategic measures to overcome them. In this dynamic and competitive industry, it will be crucial for AT&T to address these problems efficiently to secure a successful future.